How Much Does Tiny Home Insurance Cost?

Table of Contents

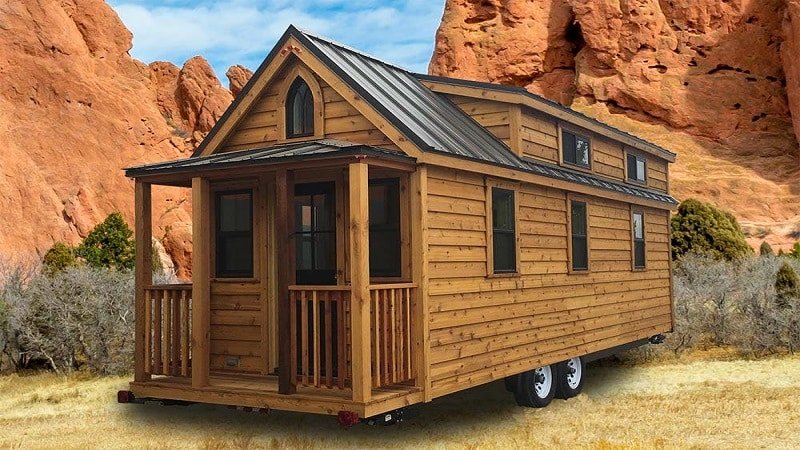

Tiny homes have exploded in popularity, and it’s not hard to see why. They are eco-friendly, low-maintenance, cheap, portable, and charming. Owners of tiny homes also have the distinct advantage of going on cross-country adventures with their homes. However, they do face one small problem, which is when they try to get tiny home insurance. Tiny homes are harder to insure than traditional homes, leaving their owners vulnerable to fire, theft, and accidents.

The good news is that insurance companies have adapted to this latest trend of tiny homes and have come out with numerous products for owners. The sustainability and affordability of tiny homes are part of the reason so many people are buying them. That’s because tiny homes allow for more economical living, greater opportunities for personalization, and are environmentally friendly. They are easier to maintain and fit the lifestyles of smaller families perfectly.

Do You Need Insurance for Your Tiny Home?

Tiny homes typically range between 300 to 500 square feet of space in size, which is why it is essential to find coverage specific to the home. Tiny home insurance is relatively new, and not every insurance company is offering coverage for tiny homes. Even though you don’t need to buy insurance for your tiny home, they are more prone to damage and accidents. Therefore, if you want to protect your personal property and home, you need a comprehensive insurance policy.

The value of tiny homes depends on various factors, like traditional homes. However, no matter how expensive your personal belongings and home are, the cost of repairing and rebuilding your home after a natural disaster or emergency can be quite expensive. If you’re looking for a full-coverage policy for your tiny home, here are some of the add-ons and coverage plans you need to buy:

· Dwelling

This covers any damage to the home structure caused by specific perils or risks mentioned in the policy.

· Personal Property

This will cover all your personal belongings inside the home, such as jewelry, valuable art, and gadgets.

· Personal Liability

This will cover the cost of any event where you are legally responsible, like medical expenses for anyone who is injured in your home.

· Endorsement/Riders

If you want additional coverage or want to change your existing plan, you should buy an insurance add-on so that your belongings and home can be replaced or repaired in case of an emergency.

Does It Cost Less to Insure a Tiny Home?

Most people believe living in a tiny home would mean having less expensive bills, but that isn’t strictly true. The cost of insuring your tiny home can range between $400 to $1,500 annually, depending on several factors. Like traditional homes, the cost of tiny home insurance is dependent on the following factors:

- Age of the home

- Amenities inside the home

- Appliances in the home

- Claims history

- Your credit history

- Any endorsements/riders you have added

- How your home was built (hiring a contractor versus DIY)

- How is your home used (live-in or rental?)

- Location of the house

- Size of the house

- Type of insurance policy (homeowners, renters, mobile home, RV, etc.)

- Type of home foundation

- Whether your home is certified by NOAH or the RV Industry Association (RVA)

Even though there isn’t a formula to determine the cost of your tiny home insurance coverage, you can request quotes from multiple insurers to find a plan that best meets your budget and needs. Most tiny homeowners tend to build their own custom insurance policy to have coverage for any potential scenario.

Insurance Challenges that Tiny Homes Face

Most tiny homeowners would attest to the fact that it can be challenging to find adequate coverage from an insurance company for their home. That’s because there are specific challenges that tiny homes when it comes to insuring them. These include four things, which are as follows:

1. The Size of the Home

Tiny homes are more vulnerable to natural disasters and wind damage. There is also a significant fire risk in small kitchens. Accidents in tiny homes are likely to destroy or damage the home compared to a small portion of the home.

2. The Value of the Home

Part of the appeal of tiny homes is that they cost less money than traditional homes. Most insurance companies don’t have policies for tiny homes since they offer coverage for homes with larger values. They don’t benefit by offering coverages for tiny homes that may not be worth much as larger ones.

3. The Materials and Design

Tiny homes are generally made from eco-friendly and lightweight materials, presenting more risks than traditional construction materials. Even if these materials and the home’s design don’t make the home less safe, insurance companies consider them unknown variables, and insurers don’t like dealing with unknowns.

4. The Portability

If you are looking to travel with your tiny home, whether it is a modified trailer or RV, or a home that can be towed anywhere, it presents significant travel risks. You could easily get into a driving accident on the road, and your tiny home could be completely demolished. The area where you park your tiny home also has an impact on the insurance costs.

For instance, if you park your tiny home near a beach on the Gulf Coast, it will have different risks than if you were camped in the Rocky Mountains in a remote valley.

All the factors above make it harder to insure tiny homes than traditional homes. However, harder doesn’t mean it’s impossible; it’s only that owners of tiny homes would have to do more legwork to find the right tiny home insurance.

Our Final Thoughts

Tiny homes are now a popular option for people who want a sustainable and affordable home. The fact that you can travel with them makes it more appealing, but finding tiny home insurance can be tedious. Tiny home insurance costs the same as traditional home insurance and maybe even more expensive depending on the factors mentioned in this guide. We hope that you have all the information you need about tiny home insurance now.